Challenge 2

Upstart’s customers don’t use emails/check emails regularly, demographically they are young people – millennials & college graduates.

Solution

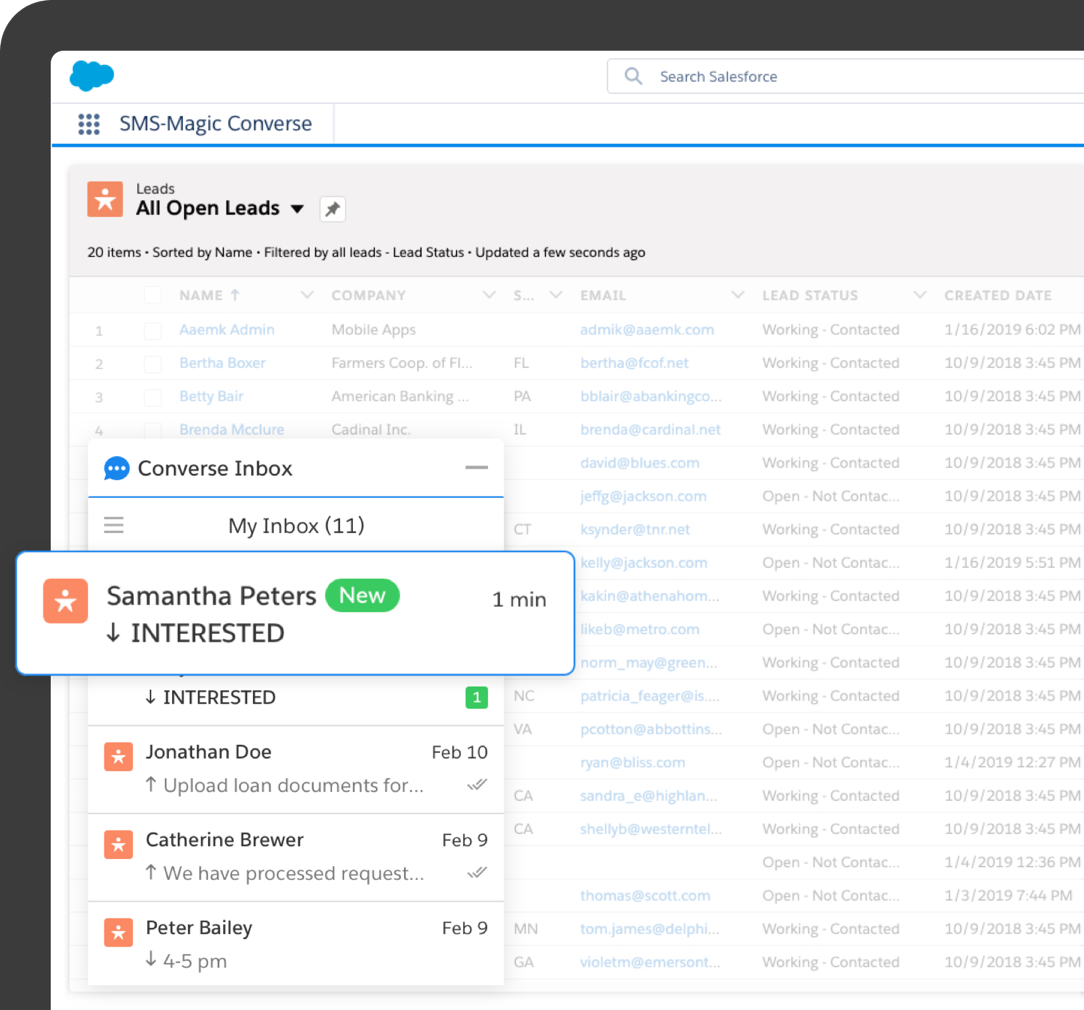

Used SMS-Magic text messaging as a primary form of communication – one that their customers were comfortable with to stay connected & updated.